Watching London’s Real Estate Crack Up In Realtime

There are many people who believe the massive bubbles within the system cannot collapse with so many people “aware” of them. Sort of like the old idiom ‘a watched pot never boils’. This position relies exclusively on sentiment as its gauge. This belief relies on tops being created with mass exuberance and wild speculation. That certainly is happening within small constructs of society that can still afford to loot and speculate with other people’s money but what happens when sentiment of the mob that has looted society becomes fearful at the very top? That may be developing in some bubbles including London real estate according to the Telegraph. That is also what happened in 2008. At the time, there was substantial panic developing at a major asset market peak. I had written before that collapse on numerous occasions that sentiment would fail as an indicator. And I have written incessantly since that with the reflation of assets, those who owned them would find that they are stuck with them. That the remaining players were in the process of trading all of the counterparties out of markets.

Who can afford to buy a house for a million bucks or a stock discounting a thousand years of earnings? Or, more importantly, who can be so ignorant?

Nothing could represent this more than the value of London real estate. London is the world’s epicenter of fraud. In many ways, much more fraudulent that even New York. Every fraudster and scumbag around the world can find a haven in London as long as they have plenty of money. And the law that protects wealth and class privilege in England turns a blind eye. This has contributed substantially to the massive swell of real estate prices in London.

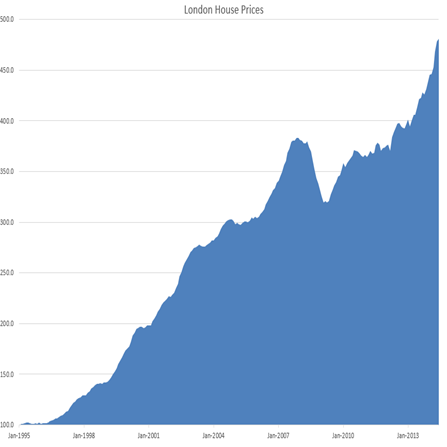

I pulled the data below from the UK land registry after reading the article linked to above in the Telegraph. It is of London real estate prices since 1995. Long time readers will recognize 1995 as a very important date. In many ways 1995 was the beginning of the end as central bankers tried to stop Japan’s financial implosion and in the process unleashed a storm of money around the globe. (By the way, house prices are still going up in London as just reported today.)

Let’s say you bought a London flat in 1995 for 200,000 pounds. Today, on average, it is worth 1,000,000 pounds. And we are now at the steepest price appreciation in the last twenty years. This is driven solely by the massive wall of fraudulent money unleashed upon the world by banking criminals and the political toadies that protect them.

Where will London real estate prices end to the upside? Who knows. The trend is your friend and that trend remains up. But, this is a good place to insert a remember. Many years ago I wrote that if any nation experienced hyperinflation as a result of this cycle, I thought it would be Britain.

Britain is to the United States what Merrill Lynch was to Goldman Sachs in 2008. That is, the wannabe in follow the leader. A birthright aristocracy that still dreams of its arrogant superiority in past days of looting, exploiting, predatory empire. England has tried to recreate those past days of empire by becoming the financial world’s global epicenter of fraud. Merrill Lynch played follow the leader with Goldman Sachs just as Britain does with the U.S. Remember, I wrote that Merrill was not going to make it under its current business model when John Thane was hired to save the company and spoke positively of saving the firm. Merrill Lynch was headed to zero without a Federal Reserve-Treasury structured bailout. Britain may be headed for the same fate.

London home prices from 1995 to the present. Up, up and away….

<< Home